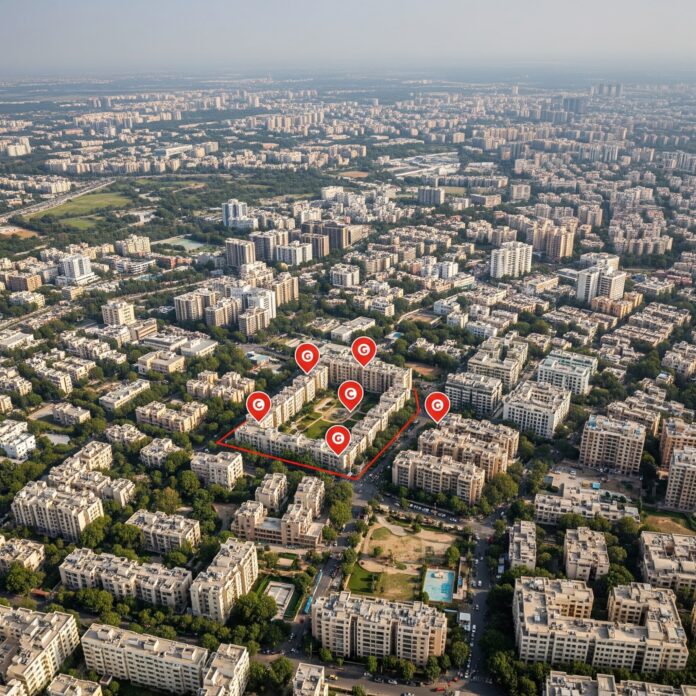

GURUGRAM: The Municipal Corporation of Gurugram (MCG) has initiated a significant drive to recover outstanding property tax dues, serving notices to 22 major defaulters who collectively owe over ₹50 lakh. This action comes as the civic body intensifies efforts to boost revenue crucial for the city’s development and essential services.

On Tuesday, the MCG taxation department issued these notices as part of a broader campaign. Each of the identified defaulters has outstanding dues exceeding ₹50 lakh. The corporation has also compiled a comprehensive list of 100 defaulters from each zone, signaling a widespread enforcement effort.

Addressing Property ID Correction Issues and Combating Corruption

Amidst ongoing challenges with property ID corrections, the municipal body has simultaneously issued an advisory to residents. This advisory strongly urges citizens to report directly to the Commissioner or Additional Commissioner if any individual attempts to solicit money for property tax-related services or corrections.

The corporation has assured prompt attention to such complaints and has committed to initiating legal proceedings against any offenders found engaging in fraudulent activities. Furthermore, the commissioner has explicitly advised residents to avoid engaging with middlemen or agents for any property tax-related matters, emphasizing direct interaction with official channels.

Legal Ramifications of Non-Payment

Under the provisions of the Haryana Municipal Corporation Act, annual property tax payment is mandatory for all types of buildings and vacant plots within MCG limits. Failure to comply with this regulation incurs an annual interest rate of 18%. Persistent defaulters are issued notices, and if the tax remains unpaid, the property in question can be sealed and subsequently auctioned to recover the dues. MCG officials underscore that these revenue streams are vital for funding the city’s development plans and providing basic services to its residents.

MCG Joint Commissioner Vishal Kumar stated, “It is essential to take strict action against those who have not paid taxes for years. If the corporation conducts this campaign regularly, transparently, and fairly, it will not only increase revenue but also foster a sense of accountability among citizens. This is a crucial step towards the planned development of the city.”

Streamlining Objections and Enhancing Citizen Support

Since April 1, 2025, the MCG’s tax department has received 11,159 objections related to property tax. Of these, 7,622 objections have been successfully resolved within the stipulated timeframe, while 554 were rejected due to insufficient documentation. Additionally, 1,700 objections were reverted to applicants due to deficiencies. Currently, only 1,283 objections remain pending at the municipal level.

To assist citizens who may be unfamiliar with the online application process, help desks have been established at MCG offices. These desks are staffed to provide guidance and assistance with various tax-related tasks, ensuring accessibility for all residents.

Furthermore, all zonal taxation officers have been instructed to diligently address citizen complaints and work towards their immediate resolution. The joint commissioner has emphasized that no application should be kept pending without a valid reason, nor should it be rejected or reverted arbitrarily. Any employee found to be negligent in their duties will face departmental action, reinforcing the MCG’s commitment to efficient and transparent service delivery.